|

After a roughly 35% plunge from their February high point to their lows around 23rd March, global and Australian shares have rallied 15-20%. What’s more this rally has occurred despite increasingly bleak economic data and a record 10 million surge over two weeks in claims for unemployment payments in the US. However, volatility remains very high.

It’s true to say that markets usually lead, looking forward 6-12 months. We have seen massive fiscal and monetary stimulus over the last few weeks to match the COVID-19 threat to economies. So maybe we have already seen the low for shares? Or maybe not? There is still a lot of bad news ahead regarding the virus and the economic hit. We still don’t know how long the shutdown will last and hence it’s hard to gauge the size and duration of the economic hit, when the recovery does come. Past bear markets have often been interrupted by strong rallies, e.g. October/November 2008 saw two 19% rallies in US shares followed by the ultimate low in March 2009. This could be the case here even if we have entered into a bottoming process. So, what should we look for in terms of when we can expect a bottom or be at least somewhat confident that the bottom has been reached? Not that anyone will ring a bell at the bottom or waive a red flag to signify the bottom. The things we are looking for:

Confidence that COVID-19 will soon be contained This is important as it will give guidance as to the duration of the shutdowns and their severity and hence the first round hit to the economy. There are several key things to watch:

|

|

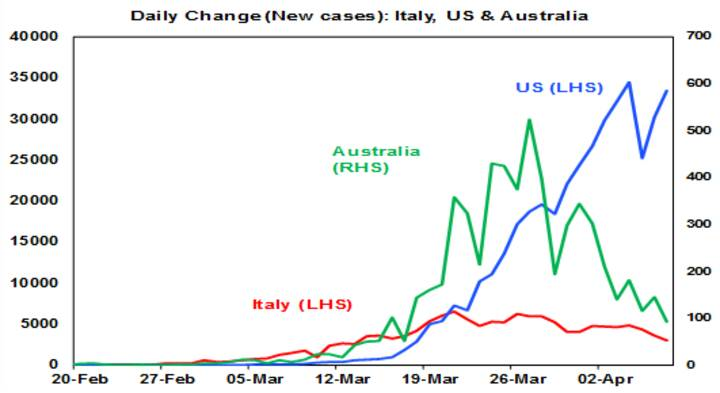

Source: Worldometer, Bloomberg, AMP Capital

|

|

The bottom line on this is that there are a lot of balls in the air but the decline in the number of new cases in several countries including Australia indicates that shutdowns are working which in turn holds out the hope that they can be relaxed in a month or so (providing containment measures are rigorous). International travel will likely be the last restriction to be lifted. Confidence Policy Measure to Support the Economy The past month has seen a massive ramp up in monetary and fiscal measures globally and in Australia to support businesses, jobs and incomes through the shutdown period and to keep financial markets functioning properly. Policy makers are committed to doing whatever it takes to provide confidence and limit the damage from the shutdowns, which will enable economies to recover once the virus is under control. We rate this as positive, although more may still need to be done. Technical Signs of a Market Bottom Market bottoms usually come with a bunch of signs.

Concluding Comment Given the uncertainty around the length of the shutdown, risks of a second wave and very poor economic data to come it’s still too early to say with any confidence that we are at or close to the bottom. Trying to time market bottoms is always very hard so a good approach for long term investors is to remain invested and for new investors t average in over several months. |