Super savings are for retirement. However, as a result of the financial hardship caused by Coronavirus, access to super may be an important way to help you make ends meet at a difficult time. We consider how you can boost and rebuild your retirement savings when your circumstances allow.

Early access to super – important considerations This is an exceptionally difficult time for many people. Accessing some of your super savings may help you to make ends meet until your circumstances improve. If you were eligible, you may have been able to make an application to withdraw up to $10,000 from your super fund before 30 June 2020. You may also be eligible to make another application for a second amount of up to $10,000 from 1 July 2020 to 31 December 2020(1). Before you do, it’s important to consider:

Note: For more information about eligibility and how to apply to access your super early under compassionate ground - Coronavirus, please see ‘KnowHow: Early access to your super – Coronavirus’ and ‘How to apply for early super access – Coronavirus’. The impact of a withdrawal on your future retirement savings will differ based on a number of important variables, including:

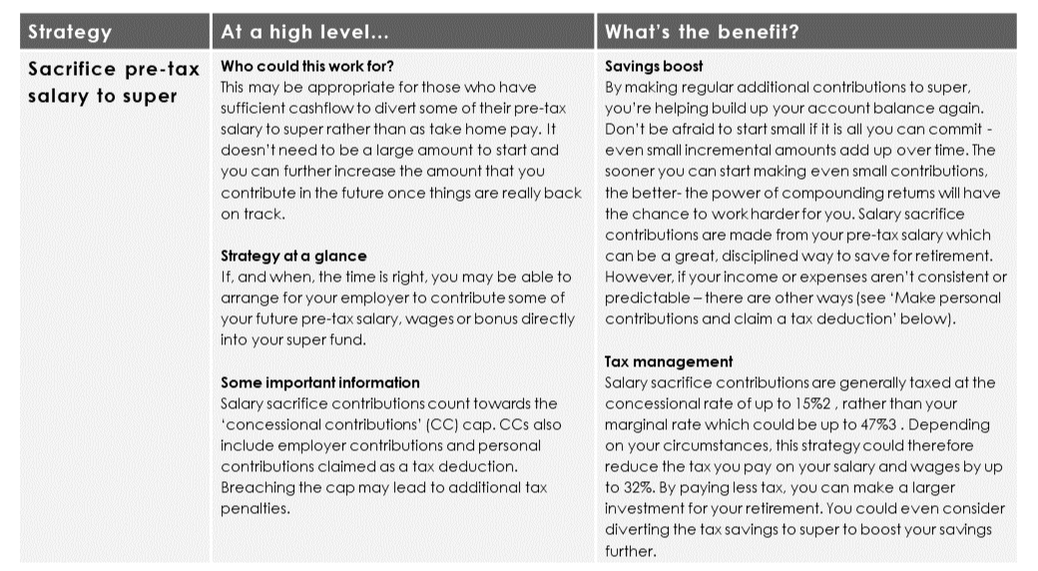

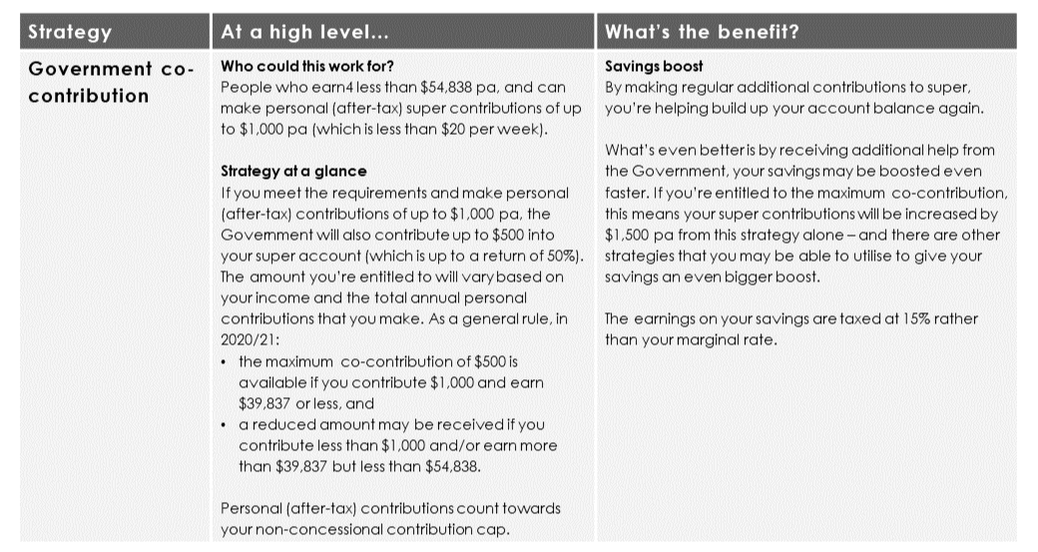

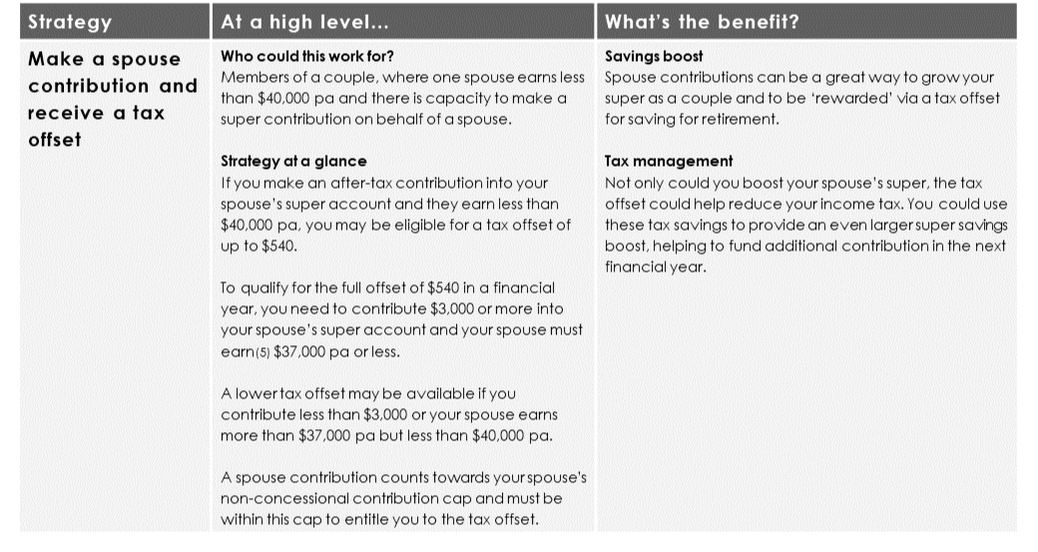

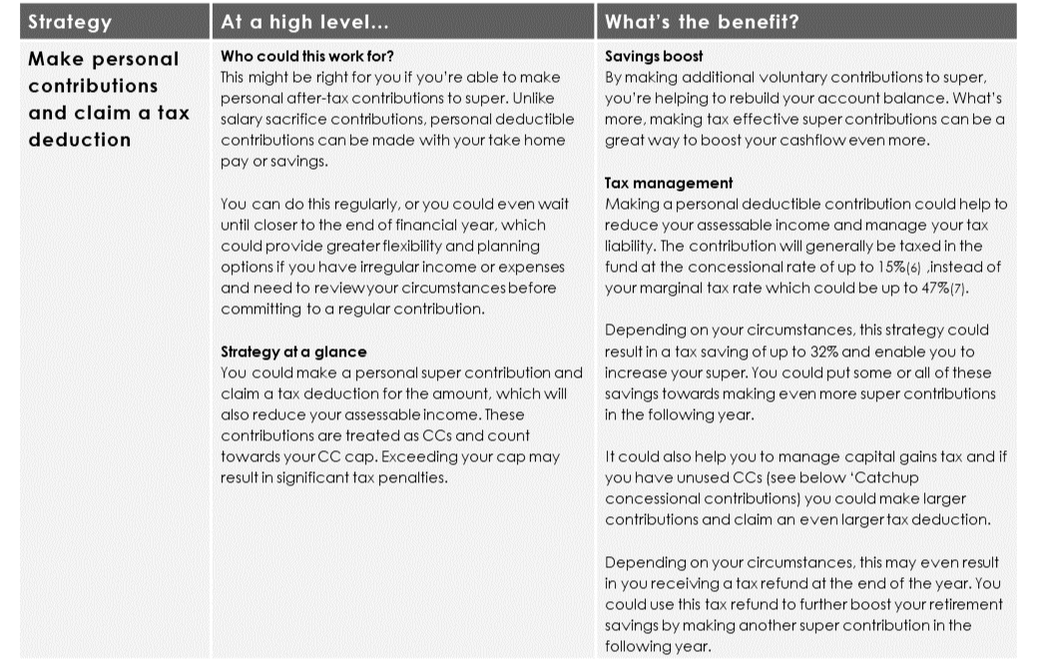

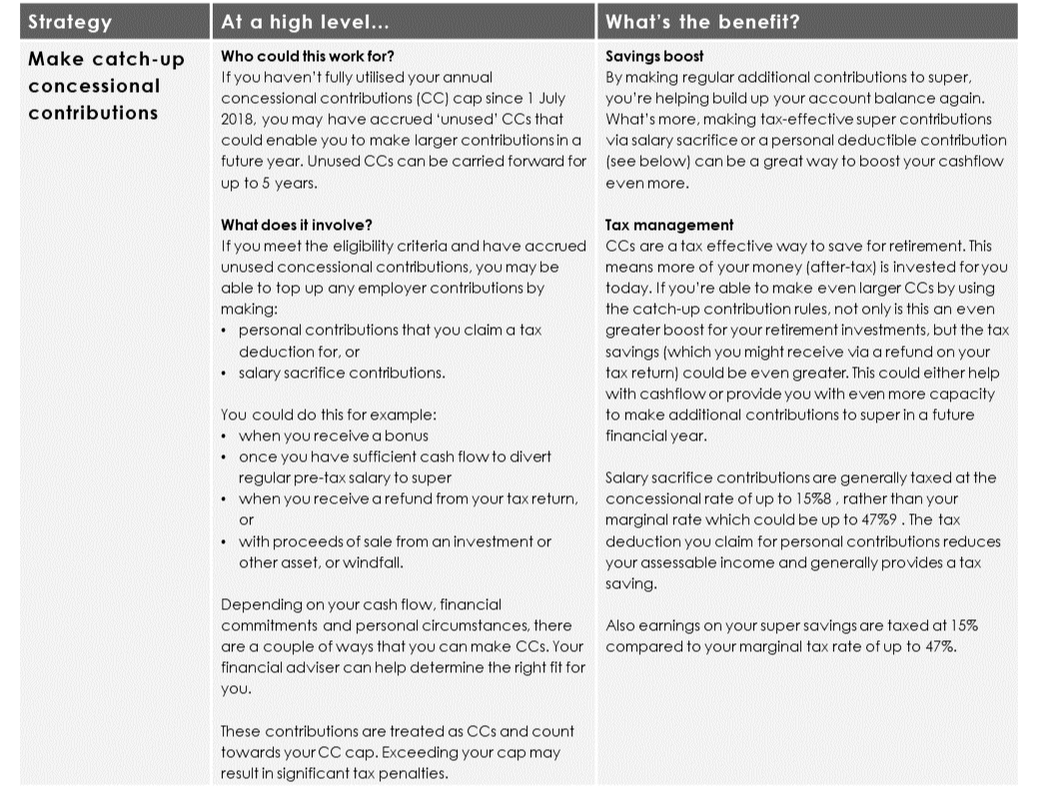

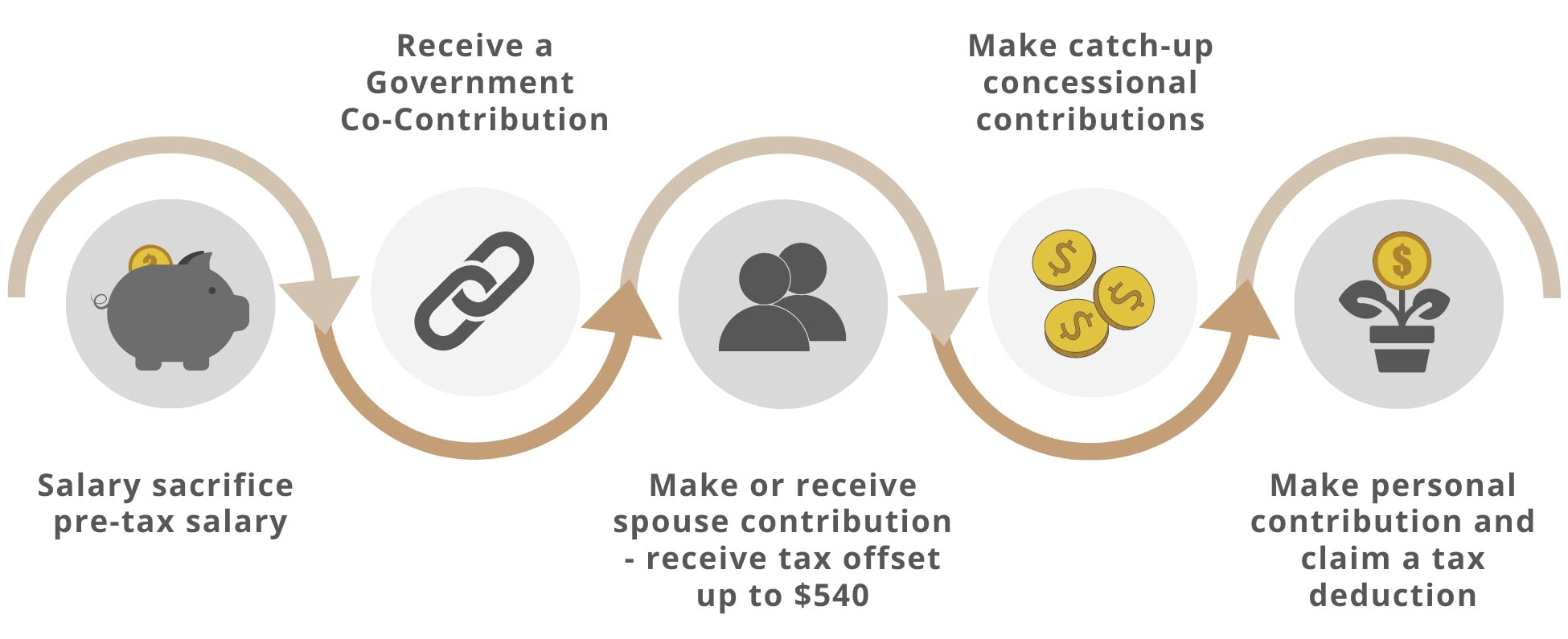

We provide a case study at the end of this article to show the potential impact on retirement savings of withdrawing funds from your super today. The great news is it doesn’t have to be a trade-off between the importance of making life work for ‘the now’ and ensuring you can have the retirement you desire. With some careful consideration and the right mix of strategies, you could get your super back on track when the time is right. Boosting and rebuilding your savings While your top priority at the moment is maintaining the cashflow you need to meet ongoing family and lifestyle expenses, there are some great ways that you may be able to boost your retirement savings in the future when your circumstances change. We have summarised how some of the below strategies could help you to boost your retirement savings between now and retirement. When your circumstances change and you have opportunity to consider rebuilding your retirement savings, think about it as soon as possible. The sooner you start, the more chance you’ve got to ensure you can get your super savings back on track. Strategies at a glance Below is a summary of some of the key contribution strategies available to boost and rebuild your retirement savings. To find out if these strategies are right for you and to understand more about the rules and eligibility conditions, speak to your financial adviser. Case study – benefits of rebuilding

Greg (50), Peter (40) and Bobby (30) have all recently been impacted by the Coronavirus pandemic, having been made redundant or stood down from employment. Each is concerned about the impact that a withdrawal under the temporary Coronavirus condition of release will have on their future retirement savings. Potential impact on future retirement savings Given each person’s circumstances, their financial adviser suggests to make the withdrawals. However, when the time is right in the future, there are a number of strategies that could be implemented to help get their retirement savings back on track. Their adviser completes some projections to show the incremental benefit of even small contributions and strategies between now and retirement. The news is good, even after withdrawing the maximum amount of $20,000. With the right advice, each of them should be able to rebuild their super savings. The projections also show that they should be able to save even more for retirement and may retire with an even larger balance. |

|

(1) The Government has proposed to extend the application deadline from 24th September 2020 to 31 December 2020. Legislation needs to be passed for this extension to become law.

(2) Individuals with income above $250,000 will pay an additional 15% tax on salary sacrifice and other concessional super contributions within the cap.

(3) Includes Medicare Levy

(4) Includes assessable income, reportable fringe benefits and reportable employer super contributions less business deductions. At least 10% of income must be from eligible employment or carrying on a business. Other conditions apply.

(5) Includes assessable income, reportable fringe benefits and reportable employer super contributions

(6) Individuals with income above $250,000 in 2020/21 will pay an additional 15% tax on personal deductible and other concessional super contributions.

(7) Includes Medicare Levy

(8) Individuals with income above $250,000 will pay an additional 15% tax on salary sacrifice and other concessional super contributions within the cap.

(9) Includes Medicare Levy.

(10) Modelling estimates are based on a range of assumptions and individual outcomes may vary. Outcomes are displayed in today’s dollars, Annual salary increases are in line with assumed rates of CPI, with employer contributions at the legislated minimums. Recommended contributions are unindexed. Government co-contributions are calculated annually based on entitlement resulting from salary and projected income thresholds. Investment returns are based on a return rate of 7.77%, and ignores fees for simplicity. Based on current tax and superannuation rules which are assumed to remain unchanged. Retirement age is 65 in all case studies.

(2) Individuals with income above $250,000 will pay an additional 15% tax on salary sacrifice and other concessional super contributions within the cap.

(3) Includes Medicare Levy

(4) Includes assessable income, reportable fringe benefits and reportable employer super contributions less business deductions. At least 10% of income must be from eligible employment or carrying on a business. Other conditions apply.

(5) Includes assessable income, reportable fringe benefits and reportable employer super contributions

(6) Individuals with income above $250,000 in 2020/21 will pay an additional 15% tax on personal deductible and other concessional super contributions.

(7) Includes Medicare Levy

(8) Individuals with income above $250,000 will pay an additional 15% tax on salary sacrifice and other concessional super contributions within the cap.

(9) Includes Medicare Levy.

(10) Modelling estimates are based on a range of assumptions and individual outcomes may vary. Outcomes are displayed in today’s dollars, Annual salary increases are in line with assumed rates of CPI, with employer contributions at the legislated minimums. Recommended contributions are unindexed. Government co-contributions are calculated annually based on entitlement resulting from salary and projected income thresholds. Investment returns are based on a return rate of 7.77%, and ignores fees for simplicity. Based on current tax and superannuation rules which are assumed to remain unchanged. Retirement age is 65 in all case studies.